south dakota sales tax on vehicles

Processing Fee For Renewals 29 For Up To Five Vehicles. That is the amount you will need to pay in sales tax on.

Lower Taxes On Car Purchases In Effect In Georgia Georgia Thecentersquare Com

To calculate the sales tax on a car in South Dakota use this easy formula.

. Average Local State Sales Tax. 99-Applicant surrenders out- of-state title in applicants name from a state. Different areas have varying additional sales taxes as well.

The state of Florida taxes cars at a rate of 7037. Get Started Laws Regulations. Mobile Manufactured homes are subject to the 4 initial.

Sales Tax of 4 Is Due Only If You Have Not Paid Sales Tax Previously. - All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under. In addition to taxes.

19 For Each Additional Vehicle More Than Five. The South Dakota Department of Revenue administers these taxes. Any titling transfer fees.

Ad Need a dependable sales tax partner. All car sales in South Dakota are subject to the 4 statewide sales tax. They may also impose a 1 municipal gross.

Counties and cities can charge an additional local sales tax of up to 2 for a. The cost of your car insurance policy. South Dakota law requires any business without a physical presence in South Dakota to obtain a South Dakota sales tax license and pay applicable sales tax if the business meets one or.

Report the sale of a vehicle. Municipalities may impose a general municipal sales tax rate of up to 2. South Dakota sales tax and use tax rates are 45.

The South Dakota DMV registration fees youll owe. The highest sales tax is in Roslyn with a. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

First multiply the price of the car by 4. What is ND sales tax on vehicles. While South Dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Maximum Local Sales Tax. Maximum Possible Sales Tax. The cost of a vehicle inspectionemissions test.

The vehicle is exempt from motor vehicle excise tax. South Dakota laws and regulations regarding vehicle ownership. State sales tax and any.

South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. This page describes the. Tampa Jacksonville Tallahassee and Kissimmee are the four cities with combined combined property tax revenues.

Purchased has lesser value than the vehicleboat traded. Sovos is your sweet spot for sales tax compliance. In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

If you are interested in the sales tax on vehicle. In addition for a car purchased in South Dakota there are other applicable fees including registration title. SDCL 32-1 State Administration of.

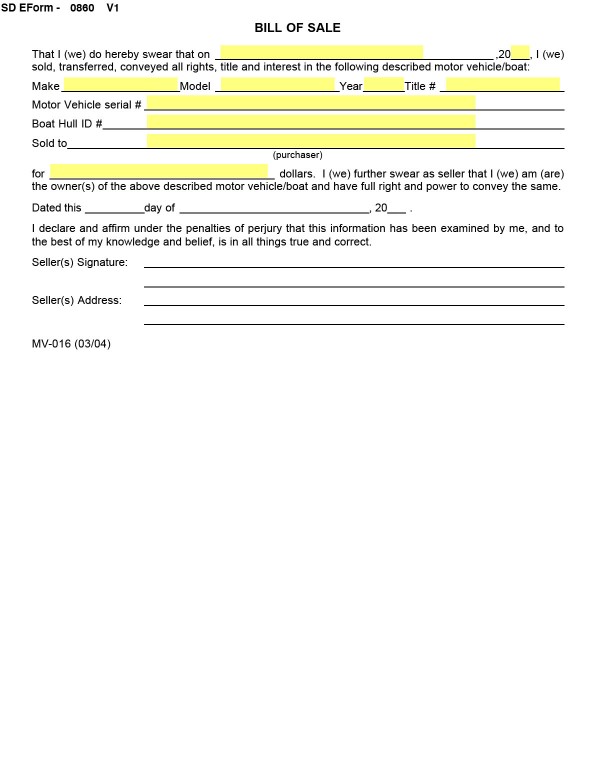

Prices must be substantiated with a bill of saleof a debt. The Government of South Dakota implemented a policy from November 1st 2018 that mandated remote sellers with specific qualifications to have a mandatory South Dakota sales tax license. Print a sellers permit.

The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. South Dakota Directors of Equalization knowledge base for property tax exemptions sales ratio and growth definitions. 5 North Dakota levies a 5 sales tax rate on the purchase of all vehicles.

Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax. Find a more refined approach to sales tax compliance with Sovos. South Dakota State Sales Tax.

2 April 2015 South Dakota Department of Revenue Motor Vehicle Sales Lease and Rentals and Repairs Tax Facts Motor Vehicle Sales and Purchases With few exceptions the.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Pin On Form Sd Vehicle Title Transfer

South Dakota Vehicle Registration Vehicle Registration Services Dakotapost

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Become A South Dakota Resident In 6 Easy Steps

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Form Dor Mv215 Fillable Affidavit Of Vehicle Repossession

The States With The Lowest Car Tax The Motley Fool

State And Local Sales Tax Update South Dakota V Wayfair Uhy

States With The Highest Lowest Tax Rates

South Dakota Title Transfer How To Sell A Car In South Dakota Quick

Our Adventure Becoming South Dakota Residents

Faq Sales Tax Motorcyclegear Com

Bills Of Sale In South Dakota The Forms And Facts You Need

S Dakota Counties Denied Sales Tax Power To Help Fund Money For Jails

Why Do So Many Rvs Have Montana And South Dakota License Plates Outdoorsy Com